The Slippery Slope of C3.ai's Earnings Report

Recent trends in artificial intelligence (AI) have given rise to promising opportunities in many sectors, but investors are now facing tough decisions concerning C3.ai—a leader in AI applications for businesses. The company's latest earnings report reveals three key numbers that could send shivers down the spine of potential investors, indicating that excitement around AI may not be enough to justify a purchase.

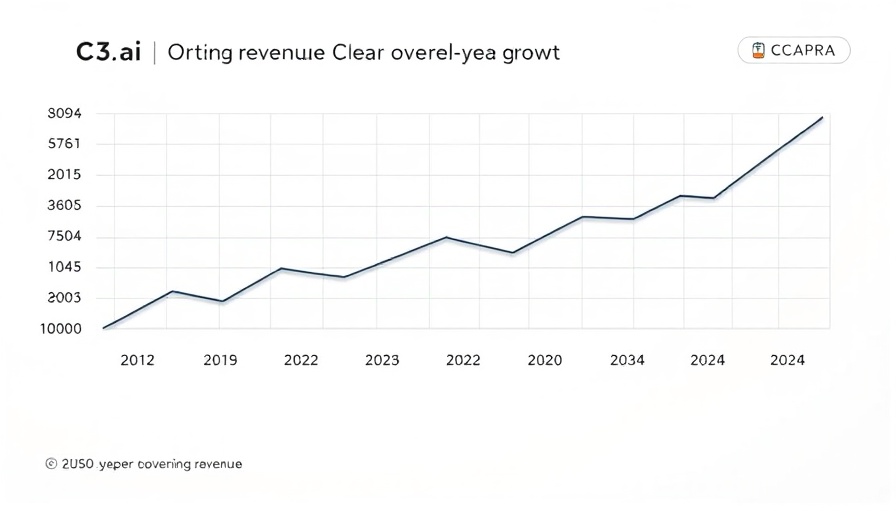

Annual Revenue Growth Shows Signs of Slowdown

In the fiscal third quarter of 2025, C3.ai reported a revenue of $98.8 million, representing a commendable 26% year-over-year growth. However, the growth rate is exhibiting signs of slowing, dropping from previous periods. This stagnation raises alarm bells about the future trajectory of AI spending across industries. With competitors potentially offering AI solutions at lower costs, this reduction in growth could hinder C3.ai's competitive edge.

Mounting Operating Losses: A Red Flag for Investors

One of the starkest insights from C3.ai's latest report is the increase in its operating loss, which worsened to $87.6 million—up from $82.5 million from the previous year. This continued financial strain signals that profitability may remain a distant target for the company. Investors looking for sustainable business models will need to weigh the implications of ongoing operational losses against the backdrop of rising AI investments.

Cash Flow Concerns: Is Dilution on the Horizon?

Over the past nine months, C3.ai has burned through a staggering $52.7 million in its operating activities, despite efforts to improve cash flow, improving from $83.7 million a year ago. The company’s reliance on stock-based compensation presents a risk of dilution, meaning existing shareholders could see their stake diminish as C3.ai raises additional funds to support operations. This strategy has become common in the tech industry, albeit with potential negative consequences for investors in the long run.

Strategic Partnerships: A Double-Edged Sword

C3.ai has forged significant partnerships with industry giants like Microsoft and AWS, aiming to drive innovation and broaden its distribution network. However, while these alliances expand potential market reach, they also highlight the company's current need for strategic collaboration amid tough competition in AI. The success of these partnerships can either bolster C3.ai's growth or exacerbate its financial woes if they fail to generate significant returns.

Understanding the Investor Psychology

Investor sentiment can be heavily influenced by the numbers and the story they tell. For AI enthusiasts, who once rallied behind the stock due to the company’s avant-garde technology, these recent earnings revelations may prompt a rethink. The aura of AI-driven growth can often mask fundamental weaknesses, but when reality hits, investors might instinctively retreat.

Looking Ahead: What’s Next?

The future of C3.ai is uncertain. On one hand, its innovative capabilities position it well within the surging AI sector; on the other, growing pains and financial instability reflect a need for caution. Current trends indicate that C3.ai's challenges may continue to loom large over its prospects as the AI landscape evolves.

As we look to the future, investors must consider the implications of these numbers and choose wisely. Could now be the right time to press pause on investing in C3.ai? For those eyeing the innovative potential of AI technologies, maintaining an informed perspective is crucial.

If you're intrigued by the fiery world of AI and wish to monitor how these indicators might shape future investment opportunities, stay connected to receive insightful updates and analyses on trailblazers like C3.ai.

Add Row

Add Row  Add

Add

Add Row

Add Row  Add

Add

Write A Comment