Understanding Nvidia's Impressive Earnings Report

Nvidia is generating significant attention as it prepares to release its fourth-quarter fiscal year 2025 earnings. Expected to be a pivotal moment, this report not only caps off an extraordinary fiscal year but also sets the stage for future growth as AI technology continues to gain traction in various industries. Analysts have estimated a remarkable 73% revenue increase year-over-year, predicting a potential revenue of $38.32 billion. It’s a clear indicator of Nvidia's central role in the burgeoning landscape of artificial intelligence and machine learning.

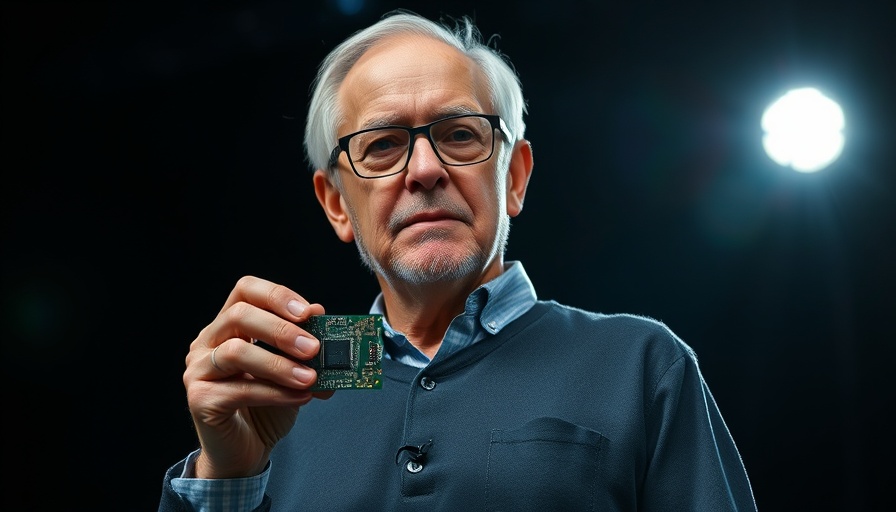

The Role of AI in Nvidia's Growth

Recently, demand for Nvidia’s data center graphics processing units (GPUs) has skyrocketed. AI tools which rely heavily on powerful hardware, like OpenAI's ChatGPT, emphasize the necessity for machines capable of handling substantial workloads and complex computations. The transition toward an AI-first world underscores why investors are so keen on Nvidia stocks. Over the past two years, Nvidia has seen its stock price soar, illustrating the sustained demand for its products globally.

Market Sentiments and Future Guidance

Investor sentiment remains optimistic, reinforced by the consensus that historical performance shows Nvidia has exceeded earnings expectations in 16 out of the last 18 quarters. Key players in the tech industry, including Meta and Alphabet, demonstrating their significant spending in AI infrastructure, bolster confidence in positive earnings reports. Nevertheless, challenges loom, particularly with concerns about competition from new AI training models such as DeepSeek's techniques which promise remarkable computing capabilities at lower costs, potentially undercutting Nvidia’s market position.

Investor Concerns and Sales Projections

Investors are particularly attentive to the analysts’ forecasting guidance for fiscal year 2026. Companies like Microsoft, although projected to maintain high budget allowances for AI infrastructure, are navigating uncertainties about future capital expenditures. Initial reports indicating a slowdown in investment paired with geopolitical tensions may cast a shadow over Nvidia's past successes, urging analysts and investors alike to reassess expectations moving forward. Uncertainty is compounded by the U.S. government's ongoing scrutiny over chip exports to China, raising questions about Nvidia's strategic growth channels amidst escalating global tensions.

Final Thoughts: The Path Ahead for Nvidia

Nvidia's impending earnings release encapsulates not just the company’s performance but its profound influence on the tech sector as a whole. As the AI domain expands, Nvidia is poised to lead in innovation and revenue growth. However, it must navigate emerging competition and geopolitical challenges to sustain its promising trajectory. This earnings call is indeed an event for AI enthusiasts and investors alike to watch closely, as it could redefine Nvidia's position in the tech hierarchy.

Add Row

Add Row  Add

Add

Add Row

Add Row  Add

Add

Write A Comment