Why Nvidia's Stock Is on the Rise

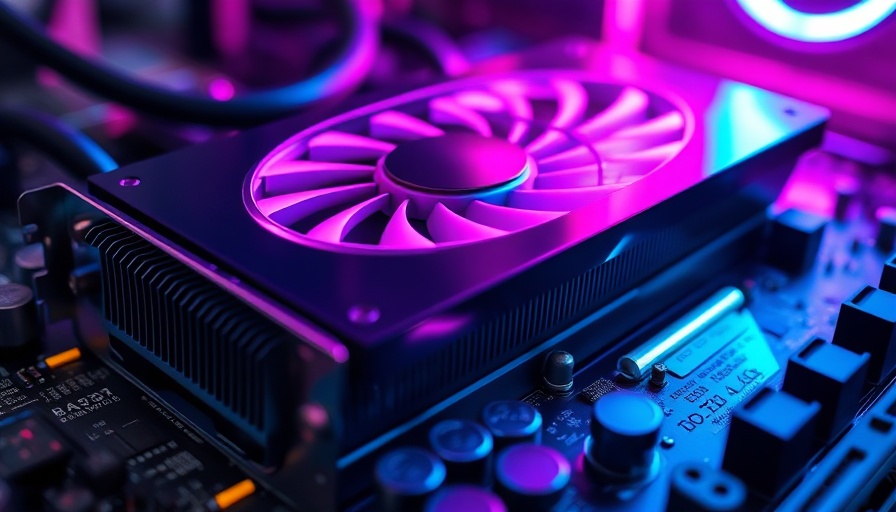

Nvidia (NVDA) has seen a notable increase in its stock value recently, driven by an explosive demand for artificial intelligence technologies. As the largest producer of graphics processing units (GPUs), Nvidia stands at the forefront of the AI revolution, amplifying its influence within various industries, from gaming and finance to healthcare and defense. This recent stock surge has sparked both excitement and caution among investors as they evaluate Nvidia’s future within a rapidly evolving tech landscape.

The AI Boom: Nvidia's Golden Opportunity

The economic landscape transformed dramatically following the release of OpenAI's ChatGPT in late 2022, prompting a surge in AI investments across various sectors. Nvidia's GPUs have become essential for training AI models, giving the company a crucial role in this technological renaissance. In fact, a report indicated that Nvidia's revenue skyrocketed nearly fivefold, reaching approximately $130 billion in just over a year. Analysts predict demand will continue to accelerate as companies strive to leverage AI to boost productivity.

Evaluating Nvidia's Market Position

Despite the positive trajectory, a significant debate has emerged regarding Nvidia's stock valuation. With a current price-to-earnings (P/E) ratio nearing 25, some analysts argue that this valuation appears more attractive than in previous years, particularly given the projected growth of the semiconductor market, which could exceed $500 billion by 2028. This perspective challenges the notion that Nvidia’s price levels are excessively inflated, especially in light of recent earnings reports indicating robust sales of its latest Blackwell chips, which constituted nearly 30% of the quarterly output.

Innovative Products Driving Growth

Nvidia has accelerated its push for innovation, developing the Blackwell series of AI chips designed to facilitate advanced software applications. With expectations of increasing sales and a continued focus on research and development, Nvidia is positioned to expand its market share amidst rising competition from companies like Advanced Micro Devices and Broadcom. The company aims to maintain its competitive edge by investing tax dollars back into development, ensuring they stay ahead in the AI arms race.

Key Support Levels and Market Trends

Investors should monitor critical price levels as Nvidia navigates through these developments. Depending on market fluctuations, key support levels range near $130 and $113, while potential overhead resistances lie around $153 and $255. The technical analysis indicates that a sustained movement above $153 could signify renewed bullish sentiment, while falling below the $130 threshold might prompt reassessments of strategy among investors.

The Road Ahead: Forecasting Nvidia's Future

Looking ahead, the expectations surrounding Nvidia's stock are tempered with cautious optimism. With analysts revising predictions to accommodate sustained AI investment growth, Nvidia is seen as a necessary component of the expanding tech ecosystem. The lower valuation compared to historic levels may present a unique opportunity for investors looking to capitalize on its potential earnings rebound. Market sentiment suggests that once production scales up for new chip generations, Nvidia's profitability may reflect positively over subsequent quarters.

Conclusion: Should You Invest in Nvidia?

Nvidia is not merely riding the AI wave—it's a major player actively shaping its course. As demand for AI solutions continues to propel Nvidia's growth trajectory, investors keen on the future of tech and AI may find comfort in the stock's prospects. Continued scrutiny of market trends, stock performance, and industry developments will be critical for making informed decisions moving forward.

To stay informed about the latest developments in AI investments and stock opportunities like Nvidia, consider subscribing to expert newsletters that provide insights tailored for technology enthusiasts.

Add Row

Add Row  Add

Add

Add Row

Add Row  Add

Add

Write A Comment