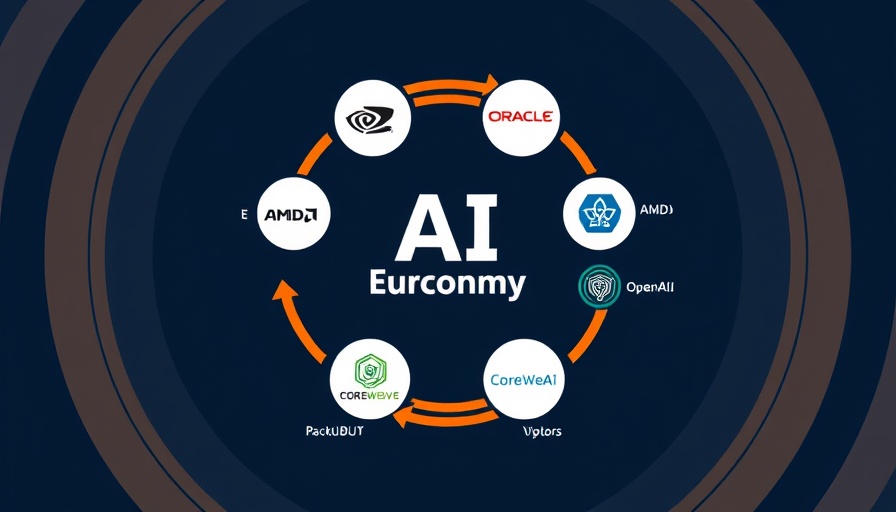

Understanding AI's Circular Economy

The rising force of artificial intelligence (AI) extends far beyond just innovative algorithms; it is ensnared in a complex web of economic transactions that, in essence, circulates vast sums of money across various players. At the center of this intricate economy is OpenAI, a powerhouse that has managed to weave partnerships with leading firms like Nvidia, AMD, Oracle, and CoreWeave. Together, these companies fuel a transactional merry-go-round that, while innovative, raises concerns about sustainability and market stability.

The Trillion-Dollar Investments

Recent developments illustrate the staggering scale of this AI economy. Notably, Nvidia committed up to $100 billion to OpenAI, which seems like a vote of confidence. However, much of this investment appears to circle back to Nvidia, as OpenAI relies heavily on purchasing Nvidia’s GPUs to power its data centers. This symbiotic relationship exemplifies how funds are circulating within the ecosystem, which some experts argue resembles strategies from the infamous dot-com bubble.

Is There a Bubble Forming?

The concerns are twofold: while these financial arrangements seem buoyed by an insatiable demand for AI capabilities, they also echo past market behaviors where cross-company financing mystified actual product demand. As AI's core usage escalates, the financial stakes have never been higher. Experts like Gil Luria have pointed out that OpenAI is projected to incur profound losses as it navigates this capital-intensive landscape, which could threaten the very deals that are meant to safeguard its growth.

Expanding Infrastructure—At What Cost?

OpenAI’s partnerships are not only impressive but necessary—at least, that's what executives argue. The company has set on a path to creating data centers so substantial that the energy they demand is likened to what 20 nuclear reactors would produce. While some may see this as innovation, others can't shake the feeling that they rely too heavily on circular deals that may not be sustainable long-term.

Corporate and Market Perspectives

There is a prevailing optimism within certain sectors, echoing sentiments from tech executives who see potential benefits in this seemingly innovative circular flow of cash and resources. For instance, Oracle's CEO emphasized that the demand for AI solutions warrants these types of partnerships. However, investors might be less persuaded, as there remains uncertainty over whether the promised returns will materialize. The circular economy might just be inflating valuations without reflecting real market demand.

What Lies Ahead for AI?

The future of AI is inherently tied to OpenAI’s strategies. If demand continues to grow and investments pay off, we could be standing on the edge of a major shift akin to an industrial revolution. However, if growth stagnates, many fear a collapse in share prices similar to what followed the dot-com crash could ensue. Ultimately, the landscape requires close monitoring, as changes in investor sentiment could affect everything from funding to product availability.

The Bottom Line

AI has the potential to redefine industries and elevate economies around the globe. Still, as we delve deeper into these circular economic models driven by leading firms like OpenAI, it becomes crucial to remain aware of the risks these entanglements may pose to the burgeoning AI landscape. The question remains: is this investment frenzy a promising leap forward or the beginning of another economic bubble?

Add Row

Add Row  Add

Add

Write A Comment