Why September Might Be Your Best Chance to Invest

As tech stocks see a notable slump at the beginning of September, investors are left wondering whether to panic or seize the moment. Indeed, the current market landscape presents a fascinating scenario for savvy investors. UBS analysts have indicated that this decline, particularly in semiconductor stocks such as Nvidia, is a golden opportunity for those willing to phase in their investments during market dips.

Understanding the Current Tech Landscape

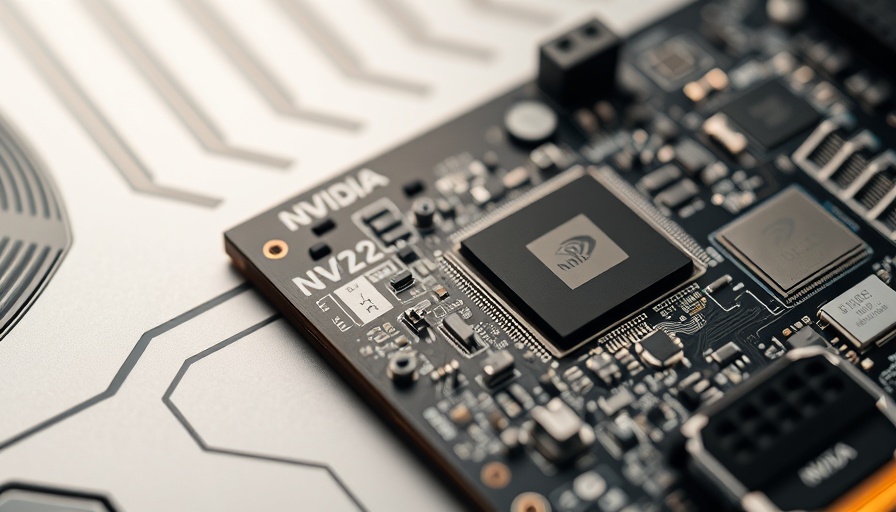

On September 2, Nvidia was marked as one of the worst-performing stocks on the Dow Jones Industrial Average, with shares dropping close to 3%. The semiconductor sector, made up of essential players like Broadcom and Advanced Micro Devices (AMD), is experiencing headwinds with the PHLX Semiconductor Index down by 2%. This decline, primarily influenced by rising Treasury yields and uncertainties surrounding trade tariffs, has disheartened many would-be investors.

Making Sense of Market Trends

Historically, September has a reputation as a challenging month for stock market performance, but UBS argues it could also act as a springboard for future gains. October and November often showcase robust returns, averaging approximately 1.2% and 4% for the S&P 500, respectively. This pattern suggests that buying during September may enhance positioning for upcoming profitable months.

Why AI Stocks are Worth the Risk

The potential of the AI industry cannot be understated. With predictions for strong demand and growth in AI applications across sectors, including healthcare and finance, investing in tech-focused stocks like Nvidia presents an advantage for future gains. UBS analysts point to a solid earnings report in Q2 as indicative of the ongoing potential in this domain.

The Importance of Diversification

According to UBS, diversification remains crucial in today’s investment climate. The firm's analysts have highlighted that investors should consider balancing their portfolios with tech sectors, healthcare, utilities, and financials, along with AI investments. This strategy reduces risk during market volatility while still allowing investors to capitalize on growth.

Diving into the Future: Insights into AI and Tech Stocks

As we navigate the complexities of the tech industry, the anticipated rate cuts by the Federal Reserve add another layer of optimism. With lower rates potentially attractive for growth stocks, sectors like AI could see a surge. Amazon, a critical player in cloud services essential for powering AI growth, also stands to benefit, making it a significant consideration in an investment strategy focused on long-term technology leadership.

Actions to Take Now

Investors willing to take advantage of the current dip can formulate a phased approach to entering the market. By systematically allocating funds into stocks poised for rebounds, such as Nvidia, they can mitigate risk while positioning themselves for significant gains as the market recovers.

Final Thoughts: Embracing the Opportunity Ahead

In conclusion, despite the current challenges faced by chip stocks like Nvidia, strategic investing can lead to considerable rewards. Market fluctuations can seem daunting, yet they can also serve as opportunities for those prepared to act. As we look ahead, embracing the potential of cutting-edge advancements in AI and technology markets remains prudent. Don't hesitate to explore expanding your investment horizons in this promising area!

Add Row

Add Row  Add

Add

Write A Comment